My investment thesis: companies that create value from thin air

by helping markets internalize externalities

As someone who enjoys forming mental models of the world and then iterating on them by constantly observing, I have long appreciated the study of economics. I’ve always admired economic theory’s ambitious attempts to mathematically understand how humans behave, but I didn’t realize just how massive this feat was until I had more life and investing experience.

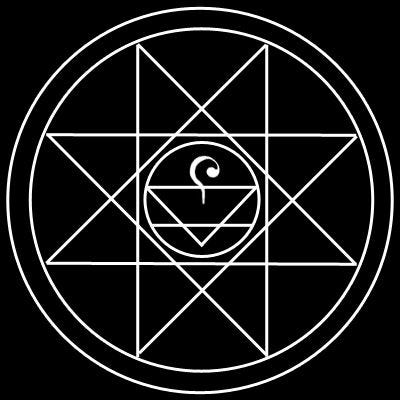

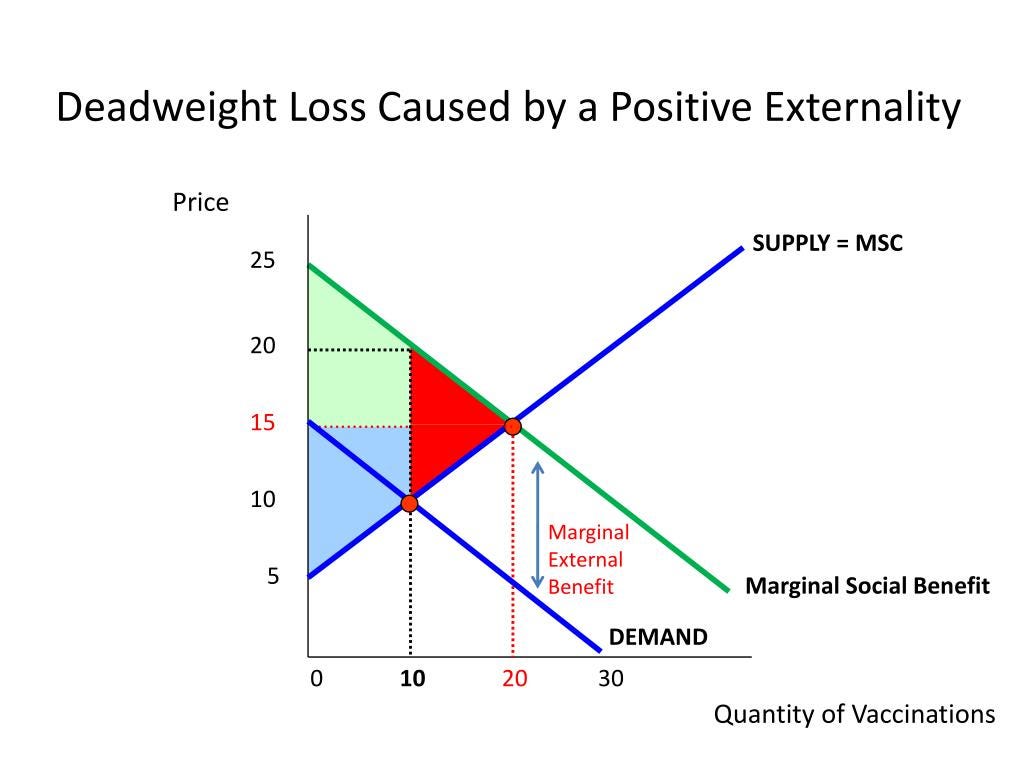

If you’re familiar with how economic theory works, you’ll remember that economists often use variables to encapsulate different factors impacting decision-making, with the end goal of maximizing an individual’s own utility. Because economic theory assumes (and perhaps in reality this is the case) that we are all 100% selfish in maximizing utility, one of the most important variables that economic theory can’t solve for in our decision-making is externalities - the benefit or cost of our actions on others.

Simplified, this means: when the cost of producing a good is lower than the benefit of having the good, we continue to produce it until the cost has increased to equal the benefit. However, if there is an externality — an extra benefit to someone else — of us producing the good (e.g. parks), we will never produce enough at an aggregate level because we are only looking at how it benefits us individually. Conversely, something that costs others something to produce in addition to what it costs us (e.g. pollution), we will produce too much of. Added up at the societal level, this is a huge deadweight loss, or in plainer terms, missed value creation opportunity. This is why we have governments to more “efficiently" (quite debatable, depending on where you live) provide for public goods like defense, schools, roads, etc. and to control for public bads like CO2 emissions, pandemics, waste etc. You may have also heard of this alternatively named as the Tragedy of the Commons, which I wrote about before.

In our increasingly hyper-connected world, it’s increasingly obvious that externalities can be even more impactful than the individual utility functions. Because of technology, the impact of our actions on others in many instances is higher than it has on our own wellbeing. For example, a viral Facebook post spreading misinformation about Covid-19, that might earn one of us the satisfaction of getting a lot of likes and shares, can create a massive amount of damage to society. As a result, there will be far too many of these vs what is most efficient. Meanwhile, a viral Facebook post that spreads the correct information about Covid-19, that might earn the same satisfaction of getting likes and shares, would also create tremendous value for society. But based on individual preferences, there won’t be enough of these vs. what is most efficient for society.

That means, today, in our technology-driven world, there are way more value creation opportunities by eliminating deadweight loss than ever.

That also means that there is a ton of value creation opportunity by internalizing externalities — better attributing the cost or benefit of producing or consuming a good or service to the various market participants so that the market can more efficiently provide a good or service. More simply said, this means realigning incentives in a way that makes people and companies care about the full impact of their actions.

This is not a particularly new idea, since governments have been trying to do this for years in the form of carbon taxes, educational subsidies, etc. However, I’m suggesting the next wave of startup value creation will come from better attributing value to individual market participants, thus improving market efficiency and creating value from thin air. This is a thesis I have been investing against for a few years.

If conceptually this makes sense to you, you may be now asking how this applies to actual business models.

Healthcare

The healthcare value chain in the U.S. is broken in ways we can’t even begin to count as I’ve written about before. More recently we’ve seen a huge wave of innovative health tech companies partner directly with employers in order to help them understand and capture their ROI measured by increased workforce productivity, ability to attract talent, and decreased churn. During the Covid-19 pandemic, our portfolio company, Spring Health, has helped many of its customers (who are employers) preemptively help their employees with their mental wellness when they needed it the most. Also, our mental health can have a dramatic impact on others around us, so the collective ROI on mental wellness is far greater than the sum of its parts. Without the efforts of companies like Spring, partnering directly with employers who are incentivized by the wellbeing and morale of the entire workforce, there would not be nearly enough preventative care supplied. In healthcare, preventative care also has huge ramifications for overall system costs in the long run.

I am excited to see more examples like this play out in the employer-sponsored care space, in categories such as women’s health, childcare, and elderly care.

Identity

Identity is the greatest attribution problem of the web. We exist digitally in disparate, vast data silos operated by the big tech giants, each using our data for their own benefit, not none having the full picture (thank god, and for obvious reasons). My digital self, for example, right now looks like a frequent buyer of vitamins and diapers on Amazon, a crypto enthusiast/part wannabe philosopher on Twitter, a gardener and a mom on Instagram, a boomer VC on TikTok, and someone who went missing 10 years ago on Facebook.

The pipes for connecting these pieces of our fragmented digital selves are already being built by companies like Ceramic and Magic Labs, and they’re giving us the power to do with our data what we want because they use distributed data-stores and keys. When we invested in these companies, what compelled us was this vision of enabling a self-sovereign identity, empowered with the full dataset of our behavior. Imagine if we had the ability to port our comprehensive identity across whichever web apps we use by giving them permission to our full data, and that the experience will be perfectly tailored to us based on our entire usage history of all web apps - value creation much greater, again, than the sum of its parts. Imagine a bank that tailors the perfect interest rate for you based on all of your data, or an insurance policy with a premium personalized to you. Imagine a media portal that comes pre-loaded with all of the things you care the most about from the people you care the most about. The opportunities here sound futuristic but aren’t too far away based on the web 3 components already being built.

Infrastructure

Video has become ubiquitous in how we interact with each other and the world. If we try to recall anyone’s face, and chances are what you’ve recalled has been reconstructed through some sort of video since most of us haven’t been able to actually see each other in person for 2 years. Yet, the infrastructure enabling video streaming is largely being monopolized by tech giants, and they charge exorbitant prices for these services — this means hundreds or thousands of cool video-based apps that won’t be started because the costs are too high (deadweight loss). Our portfolio company, Livepeer, is connecting commoditized compute power (from GPUs within its distributed network) to startups looking to stream video at a fraction of the price but with infinitely scalable infrastructure. As a result, they’ve powered an entire emerging live video economy on top. I expect to see much more exciting innovation in the Web 3 stack chipping away at the market failure problems limiting innovation in the web today.

The Digital Commons

(Ringers by https://twitter.com/dmitricherniak)

One emerging phenomenon I’ve been observing but not directly invested into yet is the NFT movement. What interests me particularly is that embedded within many of these NFTs are digital rights to things like images, videos, animations, gaming items, and even research. I’ve written before about how crypto tokens themselves (especially governance tokens) can be great attribution engines for the collective value of the protocol. However, NFTs are special because not only do they perfectly store the attribution data, they also represents rights to what is often a public digital good. Since an NFT’s value is determined by the collective future expected value of how that good is used, the fact that these digital public goods are trading at a premium suggests that there is future speculation that we will find a good way to monetize the commons (probably via DAOs). This topic is massively interesting and deserves its own post in the future.

Conclusion

Whereas in the past, private equity has largely realized value by optimizing existing business models and organizations, the first wave of venture capital realized value by helping companies migrate and then expand existing markets online. I believe that the next wave of value will be created by innovation that helps capture market externalities in a way that truly grows the pie for society.

There has been a lot of buzz recently about why young people are subscribing to the ideals of communism, even venture capitalists. I hypothesize that when people claim they want communism, some of what they’re talking about is rather better attribution of value, to allow for better societal decision-making. It’s just better capitalism.