Valuing Tokens Based on Collective Utility

We are still early down the path to understanding the value of crypto-networks. In fact, this is one of the main arguments for…

We are still early down the path to understanding the value of crypto-networks. In fact, this is one of the main arguments for institutional capital other than early-stage funds to be sitting on the sidelines today. Early stage investors benefit from the mandate to invest into the first stages of value creation based on criteria such as market size, entrepreneurial talent, and value proposition rather than cash flows, EBITDA and other financial metrics, criteria I like to think of as being more related to assessing the opportunity rather than measuring the progress. Thus, it makes sense that we are among the first to invest into this movement.

Where is the Utility Value?

However, the underlying substance that all long-term investors need to be able to invest into, irrespective of stage, is the creation of utility value — defined in economics as the total satisfaction received from consuming a good or service. Economic utility directly determines the demand, therefore the price, of a good or service; this fundamentally underlies any valuation model looking to describe a crypto-network. While there are many great efforts underway to assess token value from a macro or cost-based perspectives, the intention of this post is to propose a new way to model the basic unit of utility value in a token, an expansion of the very basic building blocks of microeconomic theory. I’d like to propose a key difference in how an individual fundamentally models her own utility:

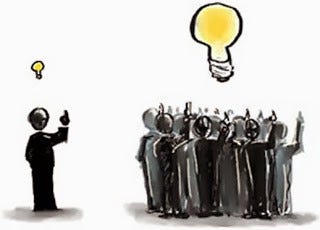

Whereas our current models of valuation rely on an individual to maximize only her own utility, irrespective of others, valuing crypto-network requires her to maximize her own utility in context of the collective utility, which she needs to have a perspective on.

A Quick Refresher on Microeconomic Demand Derivation

An individual’s willingness to pay for a good or service is determined by her utility curves, which characterizes all the possible trade-offs between consuming various baskets of goods at given levels of satisfaction. An individual’s utility curves can be mapped against a budget constraint to derive individual demand curves for specific goods. These demand curves are then aggregated to arrive at the market demand curve which illustrates the quantity of a good or service the market is willing to buy at different prices. The intersection of this curve with a market supply curve is how you arrive at the price of a good. The individual is then a price-taker and either transacts at the market price or does not based on her own demand.

At the highest level, an individual only has to know her own preferences in order to trade in an economy for goods or services based on a market price that is determined by everyone’s aggregated preferences and supply. The market price is set regardless of whether or not the individual understands everyone else’s preferences. She can simply choose to buy or not buy based on the price set by the market. This applies to all participants in the market. It’s important to understand this to understand how our currently valuation models are flawed in considering networks.

Emerging Crypto-economic Building Blocks and Early Signs of Value

Now let’s switch gears for a minute and look at a few emerging crypto-economic building blocks and the logic for valuing each:

Meme coins/store of value tokens/NFTs: While the equation of exchange has been proposed as a useful and early model for thinking about these types of tokens, it does not discuss utility value. The individual’s utility, thus willingness to pay, for each of these is only slightly determined by her satisfaction of owning the token, especially today when most NFTs lack full-featured environments where you can actually use the asset. Willingness to pay is largely determined by her expectations of what the token will be worth in the future, as a storage of value, which is determined by her expectations of others’ willingness to pay over time. Assets that have been good stores of value in the past have been traditionally backed by something which anchors the collective belief around value storage such as scarcity (gold), history (art/antiques), trusted governments (currency), monopolies (diamonds), etc. Bitcoin was so fundamental to crypto-networks because it established, for the first time, that the collective belief around value storage can be anchored by technology and our collective digital memory.

Prediction Markets: These have been cited as the only “new” use case to come out of crypto, uniquely enabled by the technology. While we are still in the early days of experimenting with prediction markets, I, along with many other investors, are hugely bullish on them as an important economic building block for web 3.0. The entire premise of prediction markets is relying on collective belief to price probabilities around specific events. Here, again, an individual’s willingness to pay is determined by her expectations about the collective belief in relation to reality.

Curation Markets / Bonding Curves: Many of the recently popular top games in Ethereum rely on these dynamics, and in the simplest form, they can be classified as gambling. An individual has to play based on her beliefs about the others who are participating. However, as easy as it is to dismiss these types of games’ importance due to the gambling classification, they can also be studied as complex game-theoretic experiments. Continuing to rapidly generate data on how we as individuals optimize outcomes based on our expectations about the collective belief is key to understanding complex economic problems.

You’ve probably noticed the reoccurring theme between these three very early prototypes of crypto-economic building blocks:

In crypto-economics, the individual does not determine her willingness to pay based on her preferences alone; she needs to be plugged into a wider “collective” whose preferences she has to take into consideration when determining price.

Difference from Speculation — from a Black Box to the Beginnings of a Model

It’s important to acknowledge the conflation between the idea of speculation — pricing without understanding — and the idea of pricing based on expected collective value. This misunderstanding could be somewhat driven by the individualistic philosophies dominating our consciousness today. It is also driven, in large part by our limited ability to model thus fully understand collective utility in economics currently.

One of the main problems in modeling collective value has been that while the collective influences our utility, our definition of the “collective” is within our control — presenting a catch-22 problem. Also, the definition of the collective varies widely depending on the context, ranging from our family unit to all of humanity. Crypto-networks help solve this problem because they codify ones relationship with the collective into a protocol we can refer back to; they also concretely define the collective as holders of that token. By defining a constraint around the “collective”, they can be useful tools in economic model construction. In addition, they also provide real-time data from repeated, real-world experiments.

What Does This Mean for Society?

The most important implication of defining individual value as a function of the collective value is this — if we are all maximizing our own utility as a function of the collective utility, we work towards increasing the satisfaction of the collective as well as ourselves, because the two are fundamentally linked.

Intuitively, this concept is actually not that foreign. Our enjoyment of many things in life relies on the enjoyment of some sort of collective. Why do we spend so much on designer goods (and actually enjoy them)? Why do we enjoy eating at buzzy, scene restaurants rather than empty ones? (Well, sometimes at least.) Why won’t Ethereum miners collude to censor transactions or Bitcoin miners perform a 51% attack? Because the individual’s utility function is largely dependent on the collective — the expensive designer shoe is more appealing when you know a large group of fashion aficionados would covet them; the buzzy restaurant is more enjoyable because other scene New Yorkers around you are also enjoying themselves; Bitcoin and Ethereum are safe from those who have the most power to harm it because their own wealth is tied to how other network participants value the network.

By tying individual value to the collective, cryptonetworks may help us solve some of the most fundamental problems in economics such as the tragedy of the commons. I would go as far as to say in our increasingly connected world, where very few can afford to live in silos, we can no longer just look at individual value irrespective of the collective value, not because it is immoral but simply because it is inaccurate.

Existing Economic Literature

For those who are more familiar with the study of economics, I propose that this is different than economic studies of altruism, where one maximizes her own utility BY maximizing the collective utility because making others happy makes her happy. A buyer of bitcoin might slightly increase the price of bitcoin by placing a large order, which benefits all bitcoin investors, but it is still for personal gain that she does this, and the increase in the collective utility is a by-product.

It also goes beyond social influence, where information about others changes an individual’s opinions, beliefs, actions (though the designer shoe and restaurant examples might be able to be described by social influence theory). Under the collective model of utility, the individual can be positively or adversely affect by collective utility shifts whether or not she has information from others (e.g. huge price increase/drop in bitcoin).

This post is really meant to open the topic up for discussion from this lens. I really look forward to the perspectives from other thinkers, economists, sociologists, and psychologists!

Thank you so much to Matt Stephenson for helping me think through this in context of behavioral economic research and pointing me to a lot of the academic literature I’m referencing in this post.