Things to think about before investing in blockchain tokens…

You may have heard about the recent crypto-boom…and if you haven’t, here’s what I mean:

You may have heard about the recent crypto-boom…and if you haven’t, here’s what I mean:

coinmarketcap.com

The market cap of all cryptocurrencies did a whopping 3X in the last month and a half, and the vast majority of the value created is speculative. This, on the one hand, is extremely beneficial for the development of decentralized blockchain protocols because speculation fuels innovation. On the other hand, it can be extremely worrying if you’ve been following the space for some time and fear the repercussions of the tough of disillusionment, especially on the regulatory front.

It’s important to note that much of the earliest funding is through private money, via crowdsales, and there seems to be a pretty big disconnect between most institutional and private investors in this space.

While these crowdsales are mostly funded by early ether/bitcoin returns and super high net worth individuals (e.g. very risk-tolerant money), there is a good amount of new money coming in from personal investors. I heard something highly disturbing at a blockchain conference recently: “I just learned about the blockchain a couple of weeks ago, and now [a significant % of my personal wealth] is invested in tokens!” My feeling is that the average new crypto investor is greatly underestimating how risky these assets are.

Newcomers in this space must tread carefully due to the “bubbly” nature of this recent growth, though there is definitely real, long-term, paradigm-shifting value being created by amazing entrepreneurs and builders in this space (as per my last blog post).

Timing is everything

Where we are in the paradigm shift has natural implications for which technologies have the most commercial potential. Of course, people have different perspectives on this, but here are a few things to think about.

VCs began to invest in bitcoin startup in 2013, when bitcoin value crossed $1,000 and then suddenly plummeted. Cautiously, investors returned to inject nearly $800M into the space the following two years.

During these years, venture funding mostly went to bitcoin wallets and exchanges. These companies created on-ramps and off-ramps for using and investing in cryptocurrency. The thesis was rapid adoption of bitcoin as a transaction currency. However, all of this investment in bitcoin has had positive externalities for other blockchains, which weren’t realized as returns for the original investors.

Also, before 2016, investors largely invested in the application ecosystem, which was very thin and limited to bitcoin. This was before we realized that most of the value in the blockchain paradigm was being captured in the infrastructure level via tokens. Many of the core infrastructure layers hadn’t been built for applications to be able to be widely deployed and adopted, and they are still not fully built today, though they are getting there.

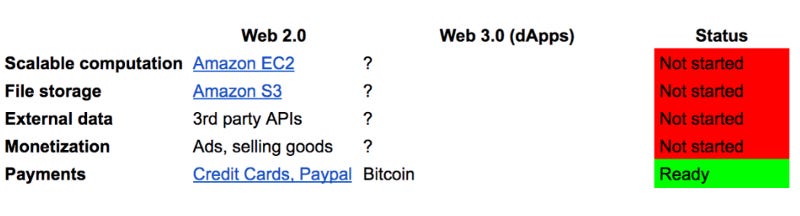

State of the dApp Developer Stack in 2014:

Taking a step back to look at the broader landscape, we can actually draw many parallels to the last time a wave of technology was so transformative that many of the earliest VCs were founded in order to invest in it (including Northzone) — The internet.

Mckinsey made a prediction in 2015 that blockchain would have 4 stages of adoption, similar to the internet. The summary is below:

McKinsey

Important to note here that the stuff promised by blockchain tokens is in the last phase of adoption according to this framework; a lot of other pipes have to be built first.

However, unlike TCP/IP, decentralized blockchain infrastructure development will be vastly accelerated using protocol tokens, which appreciates in value as the network grows. Whereas before these public protocols were developed by researchers and non-profits or piecemealed by various parties with commercial interests in building applications on top of them, the blockchain protocol financially rewards its builders directly to grow the network.

Also, unlike TCP/IP and the early internet, some of the biggest consumer adoption hurdles will be obsolete. Security is built into the network using cryptography and decentralization, so users can be less worried about their data ending up in the wrong hands. Also, trust is built into the system using smart contracts that automatically execute when certain triggers are met, so no counterparty trust is needed to transact financially as opposed to during the early days of transacting on the internet.

What do VCs think about decentralized blockchain?

Throughout these months, I’ve been discussing this with many fellow VC investors, and to my surprise, there is a relatively small intersection between VCs and hardcore blockchain enthusiasts. I’ve noted that most VC investors fall into three categories: The majority are in the ‘intellectually-curious-but-going-to-hire-an-intern-to-do-some-research’ category because they see too little near term commercial potential. A few have spent some time understanding the space but are disillusioned by the speed of consumer adoption, so now they’re deploying a ‘wait-and-see’ strategy. There are also the handful who are thought leaders and actively seeding the ecosystem, but even those who are the most bullish on the sector are hedging their bets and allocating a small % of their overall portfolio to decentralized blockchain investments. Of course, these are just my observations, and I do not pretend to represent the views of every VC investor looking at blockchain (and if I especially don’t represent yours, feel free to let me know in the comments section ;-)). It’s important to note that VCs have years of experience investing in highly risky assets, so their perspective should be helpful for private investors as they venture (no pun intended…) into this new investing paradigm.

On the other hand, this could also be a classic case of incumbents being disrupted by a new class of players, the crypto hedge funds. They possess some of the same characteristics as VCs — team, market, product diligence, and many even help projects structure their crowd sale deals. However, Crypto hedge funds are able to take part in speculative returns in a way that VCs cannot, which arguably is necessary at this point.

Many unanswered questions

While blockchain technologies promise great things, the ecosystem itself can be very reality distorting. It’s important to remember that there are still many unanswered questions about the future of blockchain, the most important being:

How will governance evolve?

Protocol rules are usually written by consensus of the decentralized nodes, which are people across various geographies with many different interests, organized into tribes. One of the major issues for the development of the bitcoin protocol is the inability of the ecosystem to reach a 51% agreement about the most minor of improvements. The Ethereum community has evolved a more political governance structure so far, influenced by a few key individuals. A form of stable governance will have to evolve in order for companies to feel comfortable leaving the fate of their businesses operations in the hands of millions of unknown strangers.

How will the monetary policy evolve?

Each new decentralized blockchain generates a token which is essentially a new currency. Speculative effects can completely distort pricing in this ecosystem, which in turn also impacts the performance of the network itself. This can negatively affect adoption by introducing uncertainty in the value exchange between creator and consumer. It can also positively affect adoption by increasing interest and aligning incentives within the network amongst token-holders. Though there are many projects working on price stability, a more holistic monetary policy will need to be implemented before mass adoption.

How will regulations unfold?

Regulators have not been heavy-handed for the most part and still exploring in regulatory sandboxes. Many expect an announcement as early as this month. While the crypto-markets are still pre-regulation, platforms like https://coinlist.co/ are trying to set some standards (or at least send signals) to keep everyone on the right side of the fence, and influencers in the space are also sending signals to regulators and private investors to tread carefully around the newly budding ecosystem.

Is there still a larger macro hype cycle we have not reached?

In order for the hype cycle to be fully realized, mass-market consumers need to be involved. So far, the ups and downs in the crypto-world are very small compared to scale of the dotcom bubble. This could very well place us in the 1993 era of the internet in relation to blockchain. However, due to the accelerative effects discussed earlier, things might progress much faster now than they did before. Thus, it is also perhaps over-simplistic to expect that history will repeat itself in the same exact way. In any case, there is still significant value to be realized in the first wave of hype cycle.

What IS the end path for mass consumer adoption?

The biggest difference between the adoption of the internet and the adoption of blockchain, which is also the biggest hurdle for the latter, is that while email delivered a completely new value to users, most blockchain use cases seek to replace existing (albeit in many cases much less efficient) systems. Therefore, it is important to look for either existing problems solvable only by blockchain when investing into this ecosystem or for substitutes that are either will be widely integrated with existing systems or drive really interesting wedges into poorly served markets, thus changing consumer behavior. I am also starting develop a hypothesis by which mass adoption happens by investment first (people buy into tokens that speak to them or align with their beliefs), then they become emotionally committed to the network, next they start to replace their existing solutions with blockchain solutions (even if it doesn’t offer a completely better product experience or solve a new pain point), and they become automatic evangelists for the product (thus, virality). This is driven by my recent observation that people are crossing the investment barrier quite easily, and it is actually how bitcoin and ether were first adopted (more on this later).

What is the total scope of the blockchain world? And where will centralized networks end and decentralized networks begin?

This is perhaps the biggest question of them all and is perhaps less a question than a philosophical leap of faith. The answer to this question will rely, in part, on your faith in the ability of humanity operate democratically, in a decentralized way.

The truth is, many of these questions are unanswerable in the near term, and they are only the known unknowns. There are so many unknown unknowns to be uncovered along the way. A new investor in this space has to understand the many moving pieces in order to be sensitive to new information and to be able interpret it in context of his/her understanding, and readjust the strategy continuously as the ecosystem evolves. That separates the long-term investor from the tourist investor, and the gains will be realized by the long term investors.