How I Evaluate Crypto Projects

One of the most exciting things about being a venture investor in this era of crypto is that you’re making new ground constantly. Digital…

One of the most exciting things about being a venture investor in this era of crypto is that you’re making new ground constantly. Digital economic primitives are being built for the first time; a path to destroying the GAFA moat is visible; technology stacks are being overhauled; and the future Jobs or Zuckerberg might be the guy or gal you brainstorm with on Thursdays in a Bushwick cafe.

Venture capital is also an industry where traditionally you had to learn via a long, humbling apprenticeship. So for the young, ambitious VC, the idea of carving out an ecosystem where none of the old rules apply is extremely enticing. However, before throwing all caution to the wind and completely unshackling from traditional VC wisdoms, I chant a daily mantra that the reality of what’s about to unfold in the short run lies probably somewhere in between conservative thinking and the most aspirational, and in the long run, it will probably surpass them both. Applying quantum thinking to all of this, the conflict zone in between these two versions of reality and the alternate realities that arise from that conflict is probably where I will spend most of my time as a venture investor in this era of tech.

“History doesn’t repeat itself, but it often rhymes” — Mark Twain.

Through reflecting on the hundreds of projects I’ve observed in the last two years (still a limited dataset compared to the universe of startups) and speaking to much wiser investors who have spent decades in VC, I’m starting to think about diligence for crypto investments from two different facets.

Facet One: The Art and the Science of Analyzing the Project itself

Why are they doing this? Everything about the team’s vision, incentives, dynamics, skills, and values are all incredibly important to the success of a protocol. I spend most of my time trying to understand this aspect of each project I work with. This question is important because of both the skills component of protocol/founder fit and the fact that there are many decisions in the design of the network that may mean a direct trade-off between the short term profit of the founding team and the longevity of the network. This ranges from things as obvious as pump-and-dump schemes to how to capitalize the network and distribute tokens. There aren’t enough robust governance mechanisms and best practices in this early ecosystem, but as these develop over time as they have in traditional tech startups, this aspect of diligence becomes more formalized into the funding process. In the meantime, I believe that founders who are more committed to the 10-year outcome of the network than their own gain/egos are more likely to make the right decisions along the way.

Can this team lead a community of thousands or tens of thousands from behind the scenes? Can they do this by understanding and tapping into other people’s own motivations? Incentives structure between a company and a protocol are vastly different, and just as companies can claim their organizations as competitive differentiation, the community around a protocol is perhaps as important as the technology itself. Whereas entrepreneurs scaling equity organizations need to be able to scale pyramidally, ruling by dictatorship, protocol entrepreneurs need to lead by inspiration, influence, and incentive design, often taking themselves out of the story line in the long run. Perhaps that means Jim Collin’s concept of Level 5 Leadership is more relevant in this paradigm.

Is the market potential for this project 100X larger than what I would consider sufficient for a traditional venture business? There is significantly more risk in an early stage investment in this sector because the adoption story is still being written and the many regulatory risks of an early ecosystem. To quantify the risk of investing, we typically try to uncover all of the known unknowns and then add another layer of risk to account for the unknown unknowns. In enterprise software for example, this layer is pretty thin, in crypto, this layer is much thicker because much more experimentation is needed in the sector before we can start to understand them. Therefore, to compensate for this added risk, the market potential for a protocol has to be much larger.

Important to note that many of these protocols are building where incumbent players can’t compete, directly commoditizing their profit centers. This is an advantage in general for the space because some may argue that GAFA poses a risk to traditional startups in this era almost as significant as the risk faced by the crypto space as a whole. Another note on market size is that in crypto protocols, we see valuation in terms of network value (market cap if at scale) instead of enterprise value, which means we’re looking at potential value of monetary supply as well as demand for the goods and services provided by the protocol rather than demand for goods and services minus cost of providing those services. This is an argument for crypto networks to be valued much higher than enterprises in this era and why we are investing in the former rather than the latter.

What is the wedge that leads to real adoption? Projects have to be the right mix of skeuomorphic and game-changing in order to create an entry point into existing user behavior to ultimately change it dramatically. Some crypto concepts are so foreign to the average person that not understanding the product and value prop is going to pose the biggest first hurdle to adoption. Also, usability, most would agree, is still very poor in this current generation of products. This includes everything from custodianship, key management, crypto-to-crypto exchanges, etc.

Some may argue we are still in the infrastructure building phase and not ready for prime time with the end user, but it’s important to keep in mind that there are many groups of users who will need different things (I go into this later). I sometimes see projects anchor around value propositions that are idealistic rather than useful. This might appeal to the first few user groups (early adopters, some developers, etc.), but won’t answer to the needs of the rest. I expect the first iteration of products to get adopted will have to look and feel at least somewhat similar to web 2.0 and address an existing user need for the immediate next group of adopters. However, the vision for the protocol still has to be big enough that it can anticipate the web 3.0 stack and evolve alongside. Finding the right balance of this is one of the things I struggle with the most in evaluating crypto protocols. I will go more into depth on this in Part Two of this post.

How does the thread of adoption string together all the different groups of adopters? Since crypto protocols must coordinate behavior between a complex group of individuals, I look for reasons to believe that there will be a strong thread of adoption between the various groups — from entrepreneurs, developers, early adopters, to mass and late adopters. Each has different motivations, preferences, and behaviors, and each shapes the incentives and user experience for the following. The protocol is a living, constantly evolving thing, so both understanding and adapting to its various participants’ requirements throughout its evolution is a competitive advantage. In the most successful protocols, the earlier adopters will design and continue to shape an incentive structure and user experience that appeals to the later-comers, even though their own may differ.

How will the protocol achieve compounding network effects? This concept is related to the last point. Usually, a network is launched with a specific type of intended network effect, but in order for the network to grow exponentially, the meaning of those network effects needs to be expanded over time to become more appealing to those outside the network, creating a bigger and bigger incentive for them to join. In the the early days of Facebook, the draw to join was basically to scope out other single Harvard students. However, as more people joined, it became a way to communicate with all of your college friends, then a way to share photos with your friends and family, and now a way to consume all types of media content, curated by your social graph. In Web 2.0, the direction and scope of these compounding network effects were shaped by a central firm, but in a protocol, it will be shaped by the participants themselves, according to the order they enter the network.

How dynamic is the protocol, and how dynamic does it need to be? Lastly, it appears that the protocols that have developed thus far have only been able to adapt by evolution, by consensus upgrading and forking. This is a slower process than the traditional tech “pivot” and potentially leaves the protocol vulnerable to competitors with even slightly better tech and a faster-growing community. It will be interesting to compare the pace of an established protocol’s evolution vs. the pace of community adoption for a new, competing protocol as this will be the ultimate determinant of who wins the race. This is the argument for having the right kind of governance model for a protocol and will largely depend on the intended use for the network. There are many more elements of governance design we could get into in diligence, as well as how the team plans to test and learn from real people during the process. However, the higher level question I always ask is how it fits the community and the network’s intended purpose.

We are still in the early phases of protocol evolution, but here are three early hypotheses about what balances the equation between governance and function: 1. A really homogeneous user base, to minimize conflict of incentives. Example could be local / regional networks or those allied around a common ideology. or 2. Really minimalist design, so basis for disagreement is minimized. Example would be single use-case protocol around something highly function-specific. or 3. A highly adaptive protocol that is constantly renewing its community of highly engaged participants.

There are several more important elements of deal analysis such as token economics, product/community fit, development pace, etc. I won’t have time to get into any of these in detail here, but they are all also very key parts of analyzing the project itself.

Facet Two: Understanding Yourself and Your Own Biases

What do I think? What do I think about what I think? A huge part of successful early stage investing is really knowing yourself, when to trust yourself, and where you are prone to bias. After I’ve processed all the answers I could dig up from the analysis part of diligence from above, I always ask myself, “Why do I now like or dislike this investment opportunity; which biases may have led me there, and how do I correct for them?” Ours is an industry that relies heavily on heuristics, but we often leave those heuristics unchecked over long periods of time. They are an interesting place to start and can get you 90% of the way there. This is really helpful for prioritization and gives the experienced investor a significant head start compared to an inexperienced one. However, I think what separates top quartile investor from the average investor is her ability to examine and refine her own heuristics actively over time. Just as a single strategy doesn’t serve a company well across tech paradigms, stagnant heuristics won’t either. Also, I believe our unexamined biases are probably the most dangerous motivators because the human tendency to rationalize is so powerful.

After getting to know someone well enough, you usually can quickly spot their biases, and when you get external references, you probably take the info you receive with a healthy dose of salt. It’s unreasonable to expect that a single person possesses the absolute perspective on reality (or that this really exists at all). The more objective truth is most likely formed by a collection of perceptions that are all relative to each other, and these perceptions are completely shaped by our brains’ flawed shortcuts. In important decision-making, I try to treat myself like one of those external references and step outside of my shoes and take a bird’s eye view on the collection of everyone’s perceptions including my own, flavored each with its own grain of salt. Even better when the collection is from all different angles of a problem and they vastly disagree with one another.

Am I thinking exponentially? This goes back to my earlier question around finding the wedge. Once I am convinced a project can get early market traction and I’ve developed a level of comfort with the known unknown risks, I have to answer to my beliefs about the unknown unknowns. The unknown unknowns are produced by the multiplication of risks, which many VCs want to avoid, but it is also the underlying key formula for exponential growth. It is difficult for humans to think exponentially due to how our brains have evolved. The min and max ranges of specific outcomes are so wide apart that it is intellectually impossible to model. However, the reality of tech progress in our era is that it is almost always exponential.

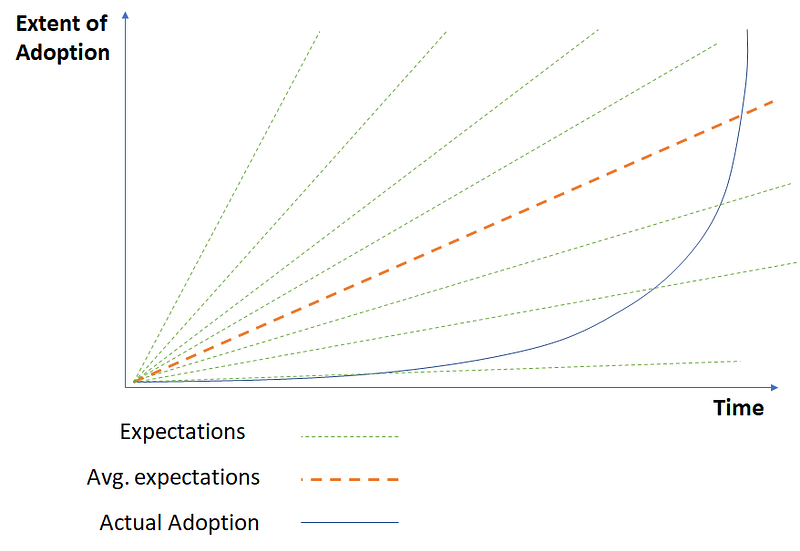

This extremely oversimplified chart demonstrates a collection of perspectives about the future vs. reality.

Lacking better information, taking an average of all of these expectations seems like the natural thing to do. However, in its linear form, this only works for speculative investing with short term horizons because you only need to match other investors expectations about the market and the state of adoption. For example, in hype markets, the average expectations slope will be much higher than the adoption curve but it doesn’t really matter, and if you invest along those lines, you will probably get a good short term return because other short term traders will validate you. The same goes for bear markets. These speculative signals can crowd out utility signals, which makes the long term investors job harder.

Long term investors investing based on utility value have to invest along several adoption hypotheses, constantly read the signals of utility, and iterate and reevaluate. Such utility signals can be the flow of talent into the sector, development momentum and quality, consumer interest and understanding, regulatory direction, and institutional adoption. I am constantly and obsessively looking out for these. Long term investors also have to ask questions like “Do I think the entrepreneurial team can iterate on their adoption hypothesis using real world signals” rather than “Can I accurately predict the future”.

Conclusions

Any investor spending a significant amount of time in crypto right now is making a personal investment of time and reputation in addition to the financial capital they deploy into the sector. Many do so with the expectations of potential exponential outcomes. Many also believe that we are at the beginnings of a whole new investment paradigm, which is why it’s good to remember no one is really an expert yet, and it’s best look for those who are thoughtful instead. We may find that wisdom we draw from traditional venture may only be slightly applicable, but I think it’s a good place to start. I have to conclude by thanking those who have helped me think through these starting points, especially Par Jorgen Parson, who has been a great mentor and taught me most of what I know about investing.